The fifth session of the EVOLVE2CARE Training Series for HealthTech Innovators and Researchers took place on 4 September 2025, delivering a deep and practical dive into the realities of startup fundraising. Led by Adriane Thrash, the session “Fundraising & Pitching: An Investor’s Guide” offered a no-nonsense guide to what investors actually look for—and how innovators can meet those expectations with clarity, strategy, and confidence.

One of the core themes of the session was understanding the different types of investors and what each brings to the table. Adriane Thrash broke down the key categories:

- Angel Investors: Often the first to believe in a startup, angel investors typically invest at early stages. They are usually more flexible and founder-friendly but offer limited capital and may not always bring sector-specific expertise.

- Venture Capitalists (VCs): VCs look for high-growth potential and scalability. They expect aggressive expansion, clear exit strategies, and strong returns. Their involvement often comes with structured oversight and performance expectations.

- Corporate Investors: These investors seek strategic alignment with their own business goals. They may offer more than capital—such as access to distribution channels, technical resources, or regulatory support—but their priorities may shift based on internal strategy.

- Impact Investors: Focused on measurable social or health outcomes alongside financial returns, impact investors are particularly relevant in HealthTech. They value mission-driven innovation and often require robust impact metrics.

- Public funding sources: These include grants, subsidies, and innovation programs from national or EU-level institutions. While non-dilutive and mission-aligned, public funding often comes with strict eligibility criteria, reporting obligations, and longer timelines. Innovators must be prepared to demonstrate societal value, policy alignment, and long-term sustainability.

Choosing the right type of investor is as important as securing the funding itself.

Fundraising is a strategy, not serendipity

Adriane Thrash emphasized that fundraising is not about luck or charm—it’s about building a strategic plan that aligns with your startup’s stage, goals, and long-term vision. Innovators must understand their business fundamentals and be able to communicate them effectively.

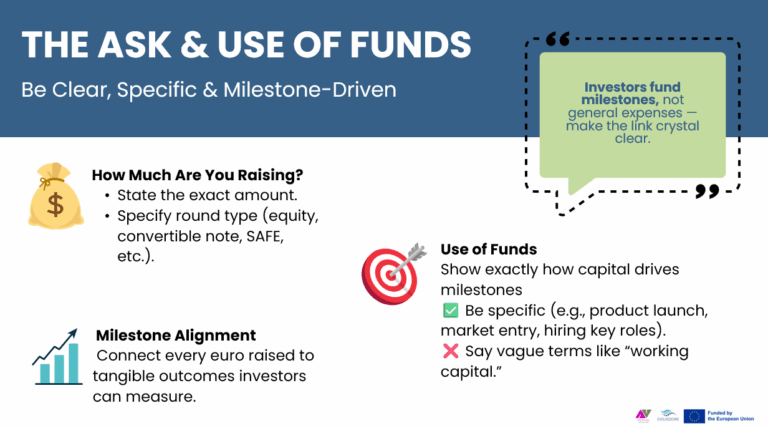

Know your numbers — and your market

Investors want facts. That means knowing your TAM (Total Addressable Market), SAM (Serviceable Addressable Market), SOM (Serviceable Obtainable Market), your projected growth, your burn rate, and your financial runway.

Transparency builds trust

One of the most important lessons: don’t hide problems. Investors are not deterred by challenges—they’re deterred by surprises. Be upfront about risks, gaps, and what you’re still figuring out. A founder who can clearly articulate both strengths and weaknesses earns credibility.

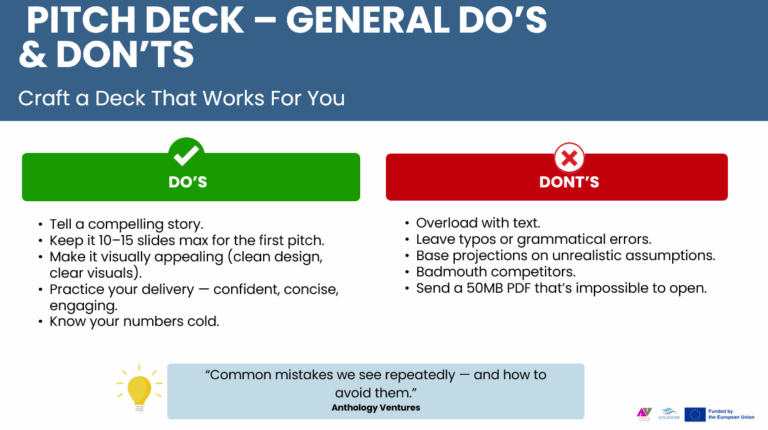

Pitching is communication

A strong pitch is built on clarity, confidence, and relevance. Adriane Thrash encouraged innovators to focus on storytelling—connecting the problem, solution, team, and market in a way that resonates. Avoid jargon, be concise, and tailor your message to the investor’s perspective.

Prepare for due diligence

Fundraising doesn’t end with the pitch. Adriane Thrash highlighted the importance of being ready for due diligence—the process where investors validate your claims, assess risks, and examine your operations. Innovators should have their data room organized, with financials, legal documents, team bios, and product details ready to share.

What’s next?

The final session of the EVOLVE2CARE Training Series for HealthTech Innovators and Researchers, titled “Measuring Impact & Scaling Pilots — Driving Evidence-Based Growth in Living Labs,” will take place on 19 September 2025 at 15:00 CEST. It will focus on helping innovators define success through SMART metrics, design effective pilot evaluations, and use data to demonstrate real-world impact. Led by Despoina Petsani, ThessAHALL Project Manager at AUTH, the session will guide participants in generating the kind of evidence that funders, policymakers, and partners require to support and scale innovation.